We all want to find the best mortgage rate.

Is checking out the lowest rate on the internet the best way to find your mortgage?

It’s not. The short answer to this is to get a good mortgage broker. If you want to know more about why, then keep reading.

I’ve bought 2 homes in my life so far. Each time I used a mortgage broker. And each time I was happy with the results.

I’m someone who likes to do their own research. But, when it comes to this, I believe using a mortgage broker is almost always best. There is one situation where I think sticking with your current financial institution is best and I’ll get into that later.

A good mortgage broker will probably find you the best mortgage rate in a way that will save you a LOT of time. I value time, and researching mortgage rates can take a lot of time if you do it right. If you do it poorly, it actually takes about 10 seconds. I timed it! You can find the lowest mortgage rate, but, it can cost you a lot of money! Which is the opposite of what you were looking for.

How is that possible?

Yeah, if you put down a large down payment, you can’t get that rate! So much for saving and trying to be responsible. You can get a better rate if you put less money down! Now, there is a catch to it. You have to pay for insurance. This isn’t the mortgage life insurance that the lender might offer. It’s insurance required by the government when your down payment is too low compared to the size of your loan.

So, let’s say you see a super low rate of 1.99%. You call them up and tell the lender or broker all you can put down is 5% of the home you want to buy. A bad salesperson will say yes, that’s the lowest rate to confirm your belief and also inform you the government requires that you buy insurance at 3%. So, your effective rate of interest is 4.99%, and then sell that to you by amortizing the cost in your monthly payments.

But, what you’re not told is that you can get a rate of, let’s say, 3% if you put down 20% or more and you won’t be required to buy insurance.

So now compare 3% vs 4.99%. That’s huge difference on a mortgage.

Just like an investment advisor selecting stocks for their client, for one client the “best” stock might be a solid blue chip stock such as BCE. For another, the “best” stock could be a more growth oriented, smaller stock. It all depends on the client’s goals and needs.

Whether you’re an investor looking for investment property, self-employed, comparing the Toronto banks, want to refinance, check in with a mortgage broker to get the best rate available, online or anywhere else.

Banks vs. Mortgage Brokers

Below is a summary if considering using a bank vs. a mortgage broker.

[table “6” not found /]What About Using Rate Sites?

Rate sites are great. They have compiled mortgage rates from tons of different lenders. I believe that’s the future of shopping for rates. But, it’s not quite there yet. Some of them provide a lot of details on the mortgage rate advertised, others, very little. Each of the three I have checked out require your contact information for someone to contact you back. Which just goes to show, you may as well contact a mortgage broker in the first place rather than doing all the searching yourself.

With all the information out there on mortgage rates and the proliferation of mortgage rate comparison sites (these are sites where they display the mortgage rates of tons of lenders so you don’t have to check the rate of the hundreds of lenders available), you’d think the best way is to just go to the most comprehensive rate site and pick the lowest rate.

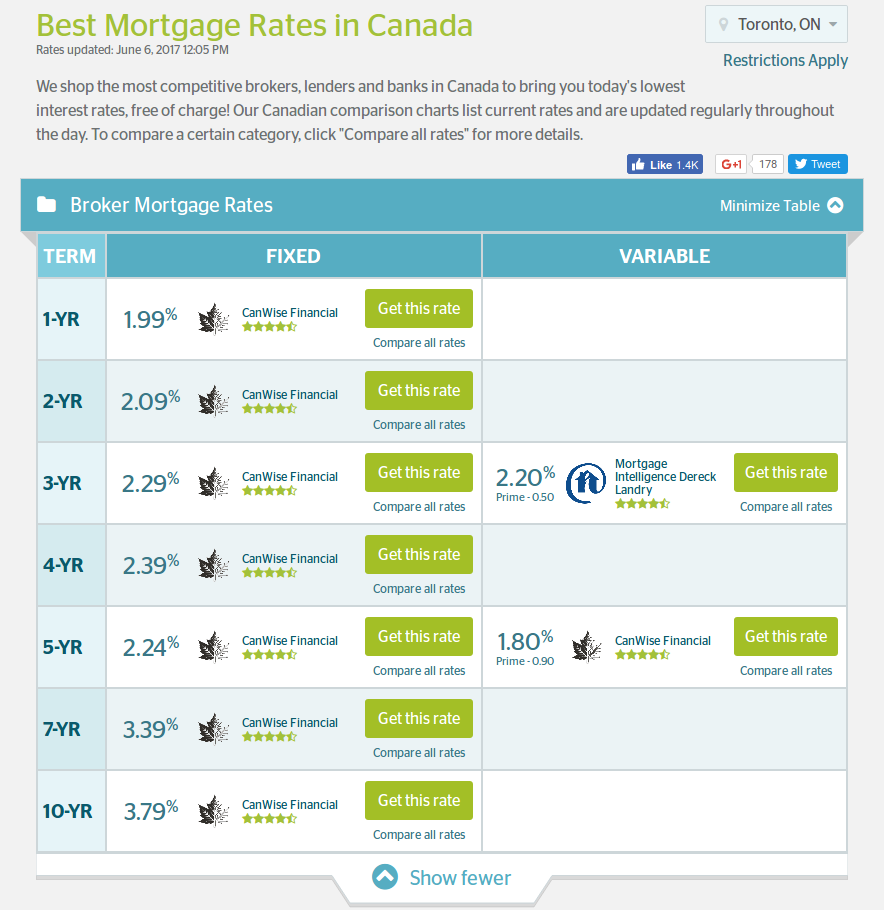

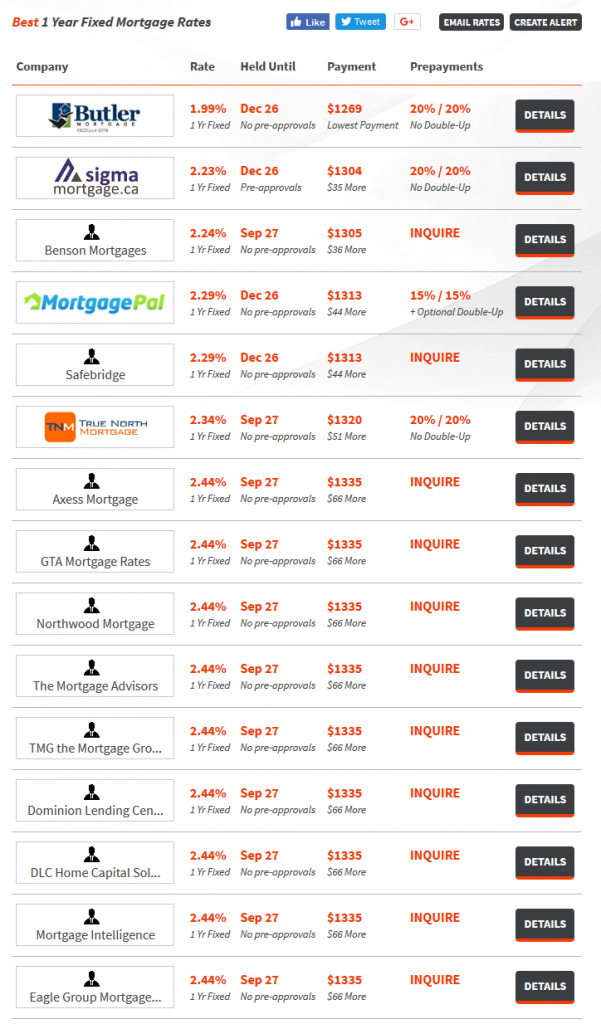

Let’s look at an example when I compared Ratespy and Ratehub, both very popular Canadian sites that list mortgage rates from multiple lenders. I took a snapshot of their 1-year fixed rate listing on August 28, 2017. This is just the first page and it’s ordered by lowest rate first.

Now look at RateHub which claims to be Canada’s most popular rate site. I took a snapshot of their 1 year fixed rate as well on the same day within minutes of taking a snapshot of Ratespy.

Notice that Ratespy shows the lowest mortgage rate at 1.99% and lists 6 different mortgage brokers with lower rates than Ratehub. Ratespy also has many more listings than Ratehub.

What’s also interesting is that Ratehub lists MCAP and Ratespy does not. But, MCAP does not sell directly to the public, only through brokers. So it makes sense that MCAP is not listed. It makes more sense to list the brokers who sell it, which is what Ratespy probably does.

Anyways, I could go on analyzing differences between the sites. The point I want to make is not necessarily that Ratespy is better than Ratehub, but, that it’s not that simple to just choose a rate from a rate site.

The lowest rate isn’t necessarily the best rate for you. The best rate should take into account your personal situation. The reason is that your situation may have certain conditions and limitations.

For example, are you renewing and planning to finish off your mortgage in less than a year? Are you buying this place and then possibly moving shortly after? These and other situations can affect which mortgage you take and it comes down to getting the lowest rate for your situation, not just the absolute lowest rate. And the best way to do that is to use a mortgage broker. Unless you’re very knowledgeable in this area, I believe a mortgage broker is the way to go.

And to go a bit deeper regarding your personal situation, let’s take a look at the current environment (I’m writing this new part on June 1, 2020).

Right now, we’re in the midst of a recession, possibly depression. This novel coronavirus from Wuhan, China has totally crippled the entire planet. And there are hundreds if not thousands of people across Canada (and the world) who are now in dire straits and can’t afford the home they live in. So, they are moving.

One of the questions above when I first wrote this article was:

Are you buying this place and then possibly moving shortly after?

One of the reasons I mentioned that was because you can’t move your mortgage to a new place without a penalty unless you have the right kind of mortgage.

It’s not so different from airline tickets, where you can’t change flight times unless you pay for a premium ticket.

We all know you can buy dirt cheap airlines tickets, but, they come at a cost of features and convenience. The same goes with mortgages.

So, don’t always go for the cheapest mortgage, you have to find out why it’s cheap.

Mortgage Brokers vs. Rates Sites

As I mentioned earlier, rate sites are great. They have aggregated lots of mortgage rates for you from multiple lenders.

However, I’ve noticed that those sites don’t show any non-standard mortgage rates such as 18 months or 30 months. They show 1,2,3,4, and 5 year term rates and longer (all the whole numbers) because they make up the majority of mortgages.

The funny thing about using sites like that is that you probably want to find the lowest rate. But, you can’t really tell what is the lowest rate without knowing all the conditions involved with that rate. For example, will you take a 1.99% mortgage rate knowing that you cannot use that rate on another home if you decide to move? Or will you take the 2.09% instead? That’s where a mortgage broker can help.

Plus, you may also want to find that unique rate that no one else could find. That’s where those rate sites are also lacking. I’ve checked Ratehub, which is the most popular rate site in Canada and Rate Supermarket, and I couldn’t find the 18 month Meridian deal on either website. I also couldn’t find the 30 month deal from Desjardins.

Now, I’m not sure a mortgage broker will tell you about these deals either, but, I can say that I checked the rate sites and couldn’t find them.

NOTE: Ratehub may be a rate site, but, you should also note that they own a mortgage brokerage company called Canwise Financial. It didn’t surprise me when I saw that the best mortgage rates in Canada on Ratehub for mortgage brokers were ALL from Canwise Financial. Well, actually, it did surprise me and so I ended up reading their fineprint (Disclaimer) and learned they owned Canwise Financial.

See this screenshot I took on June 6, 2017.

Note that, you can’t tell that Canwise Financial is owned by Ratehub. Because of this, I believe Ratesupermarket or Ratespy would be better sites to use for researching rates. Like myself, Ratesupermarket is not owned by brokers or owns any brokerage either. Although I recently found out that the owner of Ratespy (Rob McLister) is a mortgage agent at intelliMortgage.

Update 2017-12-28:

I noticed now, Ratespy posted a screenshot of a cropped image I posted above, the day after on Twitter. And now Ratehub actually puts down “A Ratehub Company” below each listing of Canwise Financial. Somebody from Ratespy and/or Ratehub must be watching my site 🙂

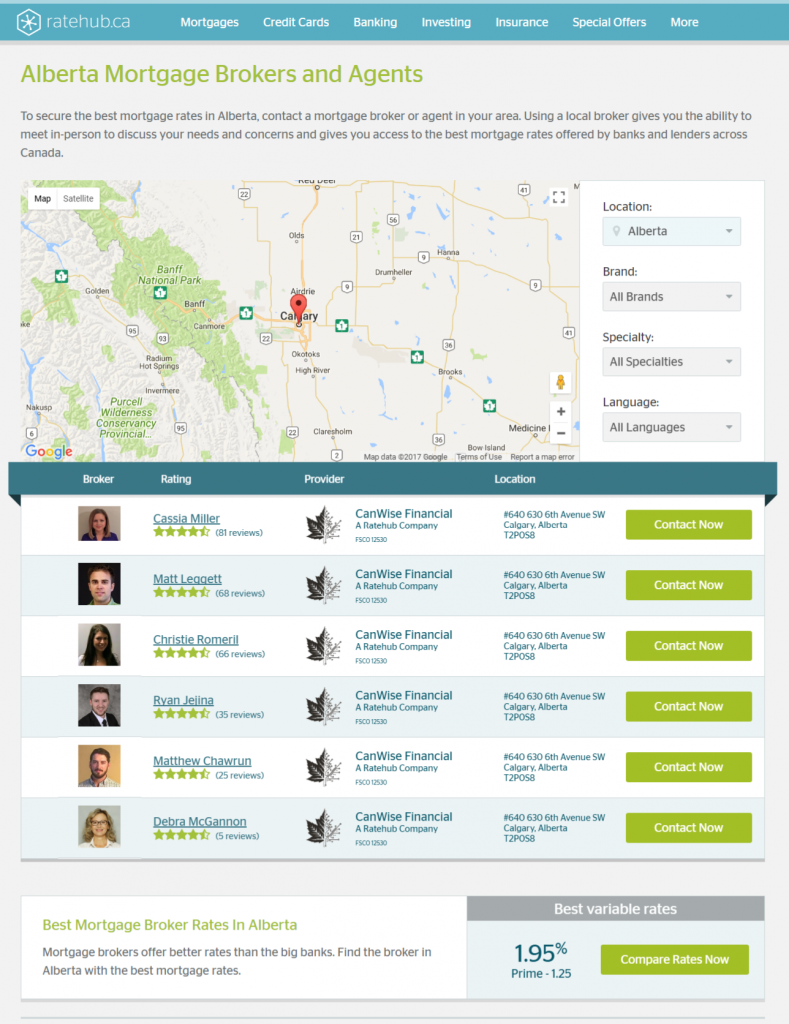

Here is another thing that should make you think about doing your due diligence. Below is a screenshot of a list of mortgage agents in Alberta from Ratehub’s website.

You see anything funny about that! Again, it’s all Canwise Financial. There’s nothing wrong if you’re looking for Canwise Financial brokers, but, if you want a list of a few more options that seems a bit more objective, then just do your own search on Google.

Below is a screenshot of the results when you type “alberta mortgage brokers” in Google. As you can see, when you use a tool that is probably a bit more objective, there are agents other than Canwise Financial that exist in Alberta!

As with anything on the internet, you have to do your own due diligence, even if the site is super popular.

And again, if you look at the list of Saskatchewan mortgage brokers on Ratehub, you get this:

And compare this to Google, you’ll see that there are mortgage brokers that exist in Saskatchewan!

Anyways, that’s probably enough about rate sites and doing your own due diligence.

I definitely think rates sites are the future of mortgage shopping. I like Ratespy and Ratesupermarket better than Ratehub. But, to me, they are still in their infancy, but, at some point, I’m sure artificial intelligence will be incorporated either in the existing sites or some new one and it will definitely give mortgage brokers a “run for their money”.

In fact, I forsee the best mortgage brokers using AI to help display or find rates for you. They will probably be like a rate site, so, eventually you’ll have tons of rate sites.

What does that mean for consumers?

I like to think of it like buying a physical product, such as a Western Digital hard drive. You know that if you buy a specific model, they are the same whether you buy it from Amazon, BestBuy, Staples, or wherever. But, where do most people probably get their hard drive? Amazon. (I’m just guessing, although it is true for me).

Why?

Because of convenience and customer service. I get my hard drive within 2 days, all the time. It’s guaranteed. Sometimes I get items the next day!

In comparison, why get a 3% mortgage rate with broker #1 vs broker #2 vs broker #n? Particularly when they can get you the rates from the same lenders.

Again, it comes down to convenience and customer service. I’ve simplified this in that a broker has to determine which is the best rate for you. It may not be the 3% rate you saw at TD. That’s the key reason for finding a mortgage broker that you can trust who will truly find you the best rate.

Mind you, getting a particular interest rate on a mortgage isn’t as easy. There are so many potential complications to getting a mortgage than buying a hard drive. Another reason for selecting a good mortgage broker.

In conclusion, rates sites still ask you to speak to a broker to complete the deal. So, you may as well just go to a broker in the first place.

The public display of rates sites definitely helps consumers find summarized information. But, I think once they have all the information including conditions, then, at least for me, I’ll be more confident in making a complete decisions online without speaking to someone. But, I definitely wouldn’t do that now.

Remember also, you need to do your own due diligence with selecting a mortgage broker, not just a rate site. You can read up about mortgage brokers in my guide, Why Use a Mortgage Broker?

How Do You Find the Best Mortgage Rate?

There are 3 ways to do it.

- Survey about 80 lenders directly and try and negotiate with all of them. Chances are you’ll get the lowest rate. Although highly unlikely, it’s possible you may have missed one with the lowest rate.

- Do your own research on rate sites such as Ratehub, Ratespy, or Ratesupermarket. But, you still can’t get all the conditions attached to the advertised rates on these sites. You’ll still have to talk to a broker.

- Just go directly to a mortgage broker. If you want to learn more about mortgage brokers, click here. Or visit my Mortgage Broker Directory.

As you can see, #3 is the way to go. Do #2 to confirm that your mortgage broker gave you something in the ballpark. That’s it!

Step by step, this is what I would do.

My method of getting the lowest rate , which I prefer to call the best rate, is just to do a bit of research (I’m talking 10-15 minutes) checking out the rates available.

Look for your primary financial institution, the major lenders, and some brokers. Then confirm the rate at the website of your primary financial institution. Go to your primary financial institution and ask for the best rate they can offer (they should question you on quite a bit of stuff to determine your current situation). Casually show them you’ve done a bit of research by mentioning rates you saw on one or two of the rate sites.

Lastly, go to a mortgage broker and ask them what’s the best rate they can get you and make sure they also know you’ve done a bit of research as well and have already gone to your financial institution to get a quote.

Finally, compare the rate from your primary financial institution and the mortgage broker and decide which one is best for you. I don’t think it’s worth going to different lenders to get quotes to see if you can get a better rate than what is quoted. Your mortgage broker can do that for you.

I also don’t believe you should play games by going back and forth between mortgage brokers or lenders to see if they will keep cutting the rates. I’m pretty sure they’ll quickly just ignore you and you may have to go elsewhere.

I like to look at it like the stock market. The most common saying about making money in the stock market is: “Buy Low, Sell High.” The key in this phrase is to note that it does NOT say, “But LOWEST, Sell HIGHEST.” That’s a recipe for chasing the impossible and probably losing money. In theory, of course, you want the lowest and highest points when buying and selling. In practicality, it’s not something worth chasing after because for the most part, it’s impossible.

Getting the Best Mortgage Rate by Staying with Your Financial Institution

I think that if you have a lot of assets with your financial institution (FI) and you have a great credit rating, you may want to stay with them.

Also, you may be the type of person who wants to keep things simple and not have more than one FI to deal with.

When you have a lot of assets with your FI, you may be able to negotiate a rate comparable to what a mortgage broker can get you. Maybe even lower. Just make sure that the sales rep you’re speaking to knows you’re doing a bit of research on your own to give them a bit more incentive!

I’m not sure how much is a lot, but, I would guess 100k or more may get you a bit of extra care. Although I wouldn’t be surprised if it’s a larger number than that.

It also may depend on several other factors as well, including the FI that you deal with and the size of the mortgage you are looking for.

Your credit rating is super important as well, possibly more so. If you are below a certain level, they can’t give you a mortgage, so obviously that’s important for them. But, if you have lots of assets they don’t want to lose you either. Definitely, that will be a conundrum for them if you are in this kind of a situation, where you have lots of assets and a poor credit. I’m not sure how they’ll handle that. In this case, I would just go with a mortgage broker.

If anyone has more insight into this or other comments about the article, please feel free to write something below.

Leave a Reply